tax shield formula apv

The tax shield could be called also tax savings and in investment appraisal this constitues a cash inflow generated from capital allowances due to investing in tax allowable. Present Value of Cash Flows formula and calculations.

Pdf Revised Comment On The Value Of Tax Shields Is Not Equal To The Present Value Of Tax Shields Joseph Tham Academia Edu

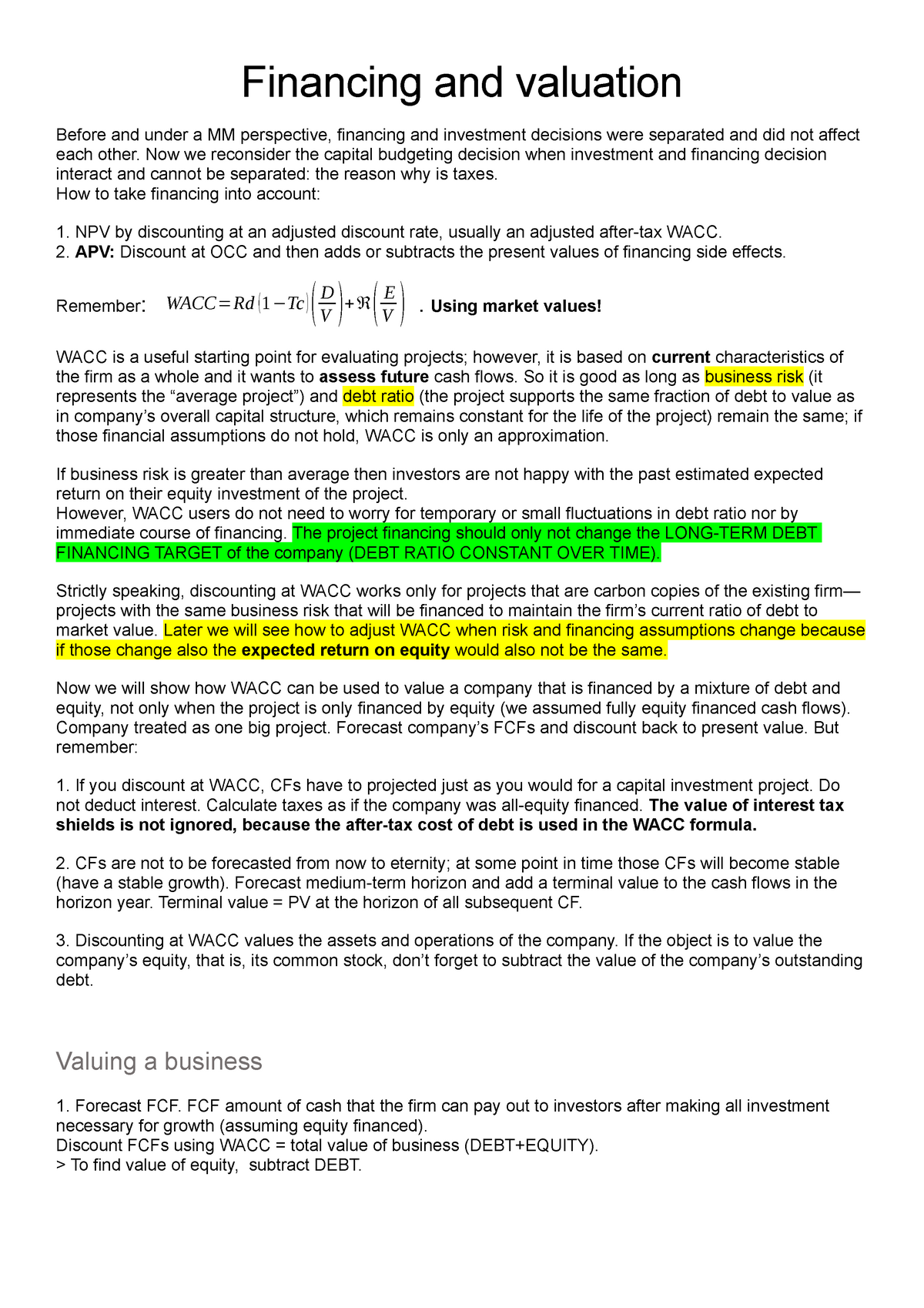

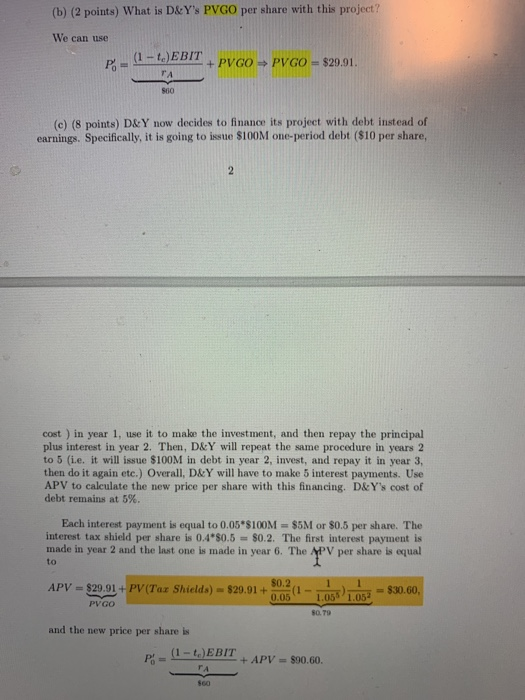

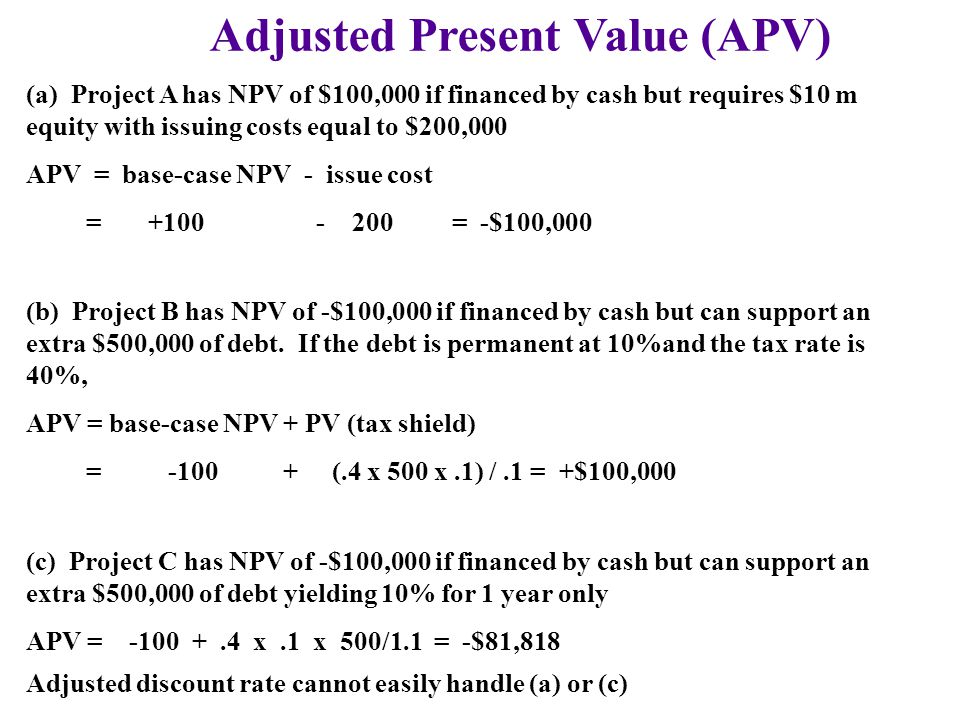

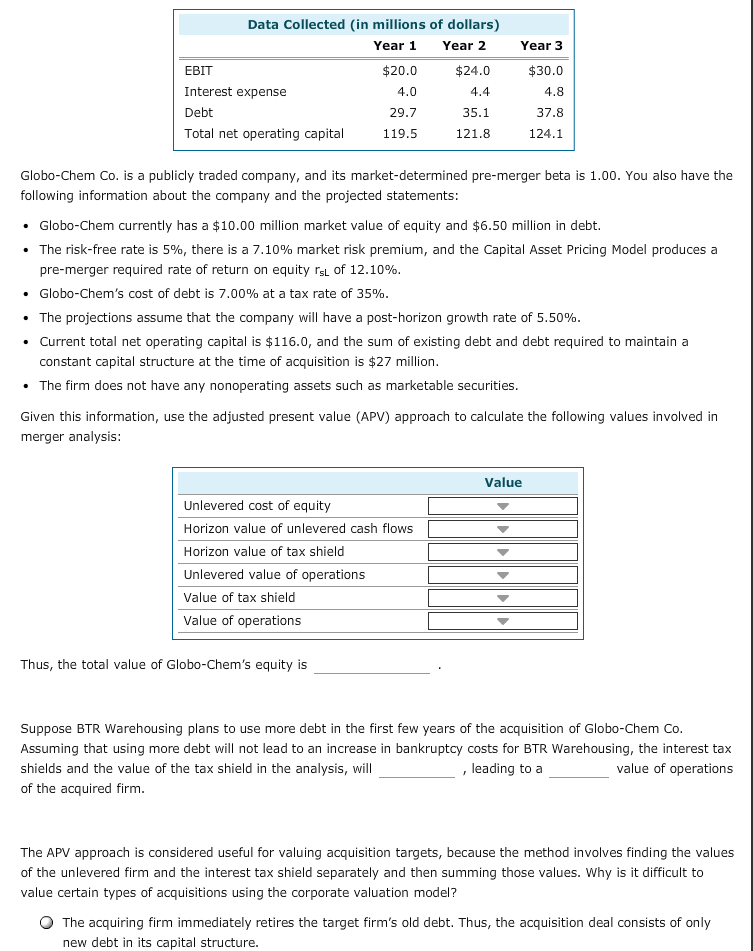

APV on the other hand seeks to value these effects separately.

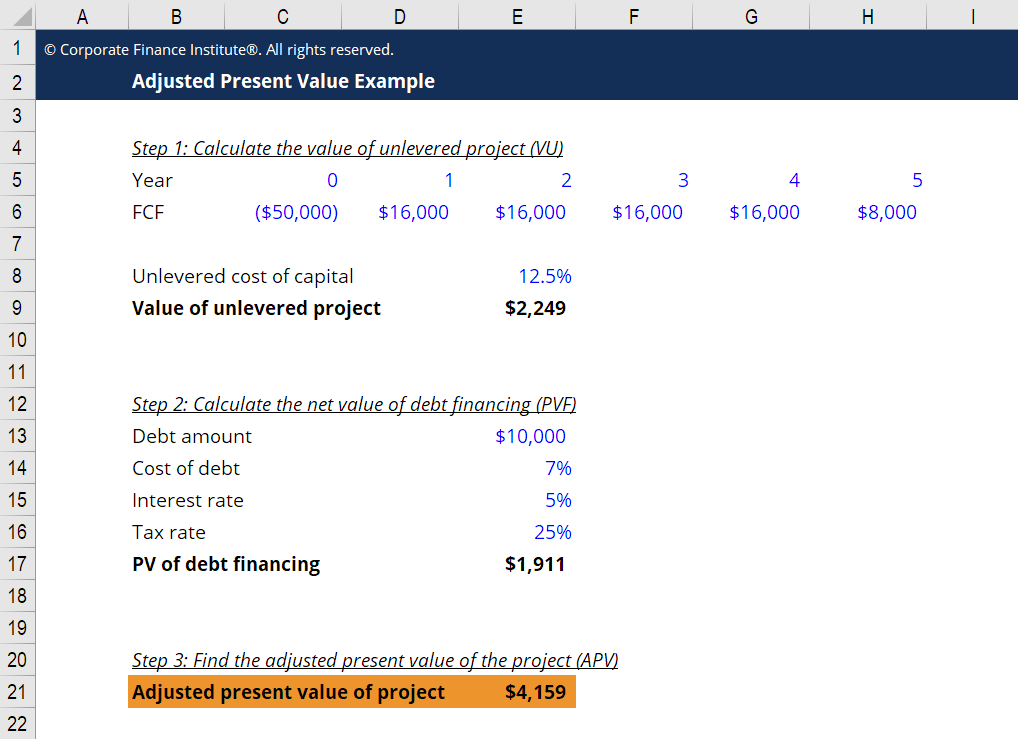

. Interest Tax Shield Formula. The adjusted present value APV analysis is similar to the DCF analysis except that the APV does not attempt to capture taxes and other financing effects in a WACC or. The Adjusted Present Value apv is.

1280 Wall Street West STE 306A Lyndhurst NJ 07071 p. Now that we have worked out all the intermediate calculations we can calculate adjusted present value as follows. The Present Value of Tax Shield pv ts is.

Apv Construction LLC Address. Apv Enterprises Inc in Piscataway NJ. APV base-case NPV sum of PVs of financing side effects.

The interest tax shield can be calculated by multiplying the interest amount by the tax rate. The present value of the interest tax shield is therefore calculated as. 500 F E Rodgers Blvd.

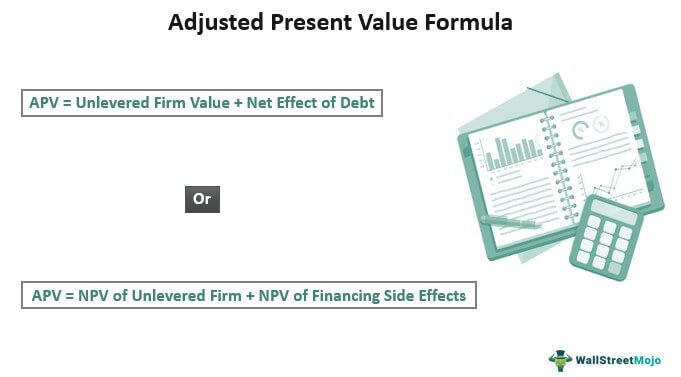

APV Unlevered NPV of Free Cash Flows and assumed Terminal Value NPV of Interest Tax Shield and assumed Terminal Value. A tax shield represents a reduction in income taxes which occurs when tax laws allow an expense such as depreciation or interest as a deduction from taxable income. APV Unlevered Firm Value Net Effect of Debt or APV NPV of unlevered firm NPV of financing side effects.

The APV method is not used as frequently in practice as is. Use our bidding system to request a quote. Interest Tax Shield Interest Expense x Tax Rate.

APV NPV L PV D 1061 million 10 million 2061. Name A - Z Mini U Storage. Tax rate debt load interest rate interest rate.

The APV helps companies understand the importance of. Pv cf cfr a mr - r100 - pc - 100 -. Fun filled with humor and great information about what to do in the.

Truck Rental Storage Household Commercial. How to Calculate Adjusted Present Value APV To.

Apv Adjusted Present Value Overview Components Steps

Session 22 23 Financing And Valuation Financing And Valuation Before And Under A Mm Perspective Studocu

Using Apv A Better Tool For Valuing Operations

Risky Tax Shields And Risky Debt An Exploratory Study

Solved In Part C What Is The Formula Of Pv Tax Shields Chegg Com

Adjusted Present Value Apv The Strategic Cfo

Interactions Of Investment And Financing Decisions Ppt Video Online Download

1 Capital Structures 2 Topics To Consider Mm Models With And Without Corporate Taxes Compressed Adjusted Present Value Model Mm Proofs Ppt Download

Adjusted Present Value Apv Awesomefintech Blog

Solved Unlevered Cost Of Equity Chegg Com

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Chapter 6 Frameworks For Valuation Adjusted Present Value Apv Instructors Please Do Not Post Raw Powerpoint Files On Public Website Thank You Ppt Download

Adjusted Present Value Apv Definition Explanation Examples

Adjusted Present Value Apv Method Formula Example

Using Apv A Better Tool For Valuing Operations

Pdf Corporate Valuation The Combined Impact Of Growth And The Tax Shield Of Debt On The Cost Of Capital And Systematic Risk